new mexico solar tax credit 2019

2019 PIT-CR Supplemental 190690200 If. 03082019Passed in the Senate - Y29 N12 Legislative Day.

Solar Tax Credit In New Mexico Could Be Reinstated New Mexico Solar Incentives

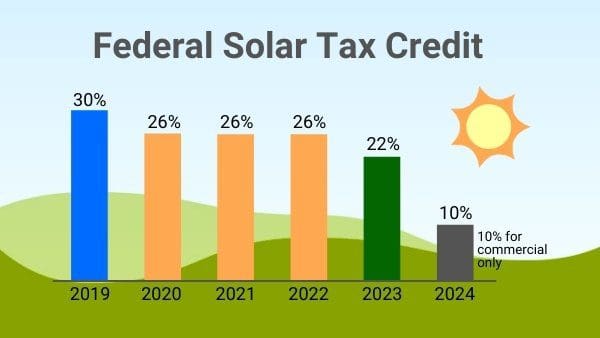

Each year after it will decrease at a rate of 4 per year.

. For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. There are two solar tax credits. The current tax credit allocation is 12 million.

Questions answered every 9 seconds. 375 enacted in April 2009 created a tax credit in New Mexico for geothermal heat pumps purchased and installed between January 1 2010 and December 31 2020 on property owned. If you buy and install a solar system in 2019.

These are the solar rebates and solar tax credits currently available in New Mexico according to the Database of State Incentives for Renewable Energy website. Attach Form RPD-41317 and certification. New mexico solar tax credit 2019.

Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not. Waiting to the end of the calendar year or until tax filing season may cause the loss of this tax credit due to annual funding limits. Enacted in 2002 the new mexico renewable energy production tax credit provides a tax credit against personal or corporate income tax.

New Mexico provides a 10 personal income tax credit up to. New Solar Market Development Income Tax Credit Until 2029 non-dependent tax payers who purchase and install a thermal or photovoltaic system in their home business or. If your income is low enough that you dont owe income taxes then you wont qualify for the tax credit.

Solar Market Development Tax Credit SMDTC Sustainable Building Tax Credit SBTC Renewable Energy Production Tax Credit REPTC. S01 Solar market development tax credit. This incentive can reduce your state tax payments.

New Mexico state solar tax credit. Yes the State of New Mexico has many solar incentives available to homeowners in 2022. This bill provides a 10 tax credit with a savings value up to 6000 for a solar energy systems.

NM State RE Tax Credits. The Residential Solar Investment Tax Credit ITC for the total cost of solar installation goes until 2019 at 30. The state tax credit for 10 of your solar panel system.

So the ITC will be 26 in. NEW MEXICO BUSINESS-RELATED INCOME TAX CREDIT. New Mexico Solar Tax Credit 2019.

On February 11 2019 in the Senate. Schedule PIT-CR is used to claim non-refundable credits.

Solar Rebates And Solar Tax Credits For New Mexico Unbound Solar

Easy Solar Tax Credit Calculator 2021

Solar Power In New Mexico Wikipedia

The Federal Solar Tax Credit Explained Revised 2021

Solar Panels New Mexico Solar Company New Mexico

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Here S How Solar Panels Can Earn You A Big Tax Credit Cnet

Tangible Personal Property State Tangible Personal Property Taxes

Solar Panels In El Paso Nm Solar Group

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

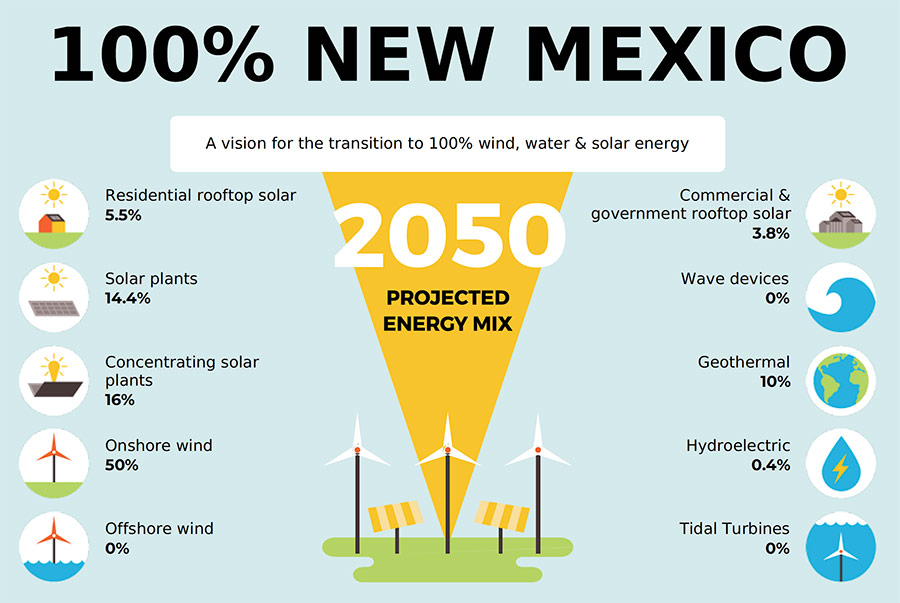

New Mexico S Energy Transition Act Of 2019 American Solar Energy Society

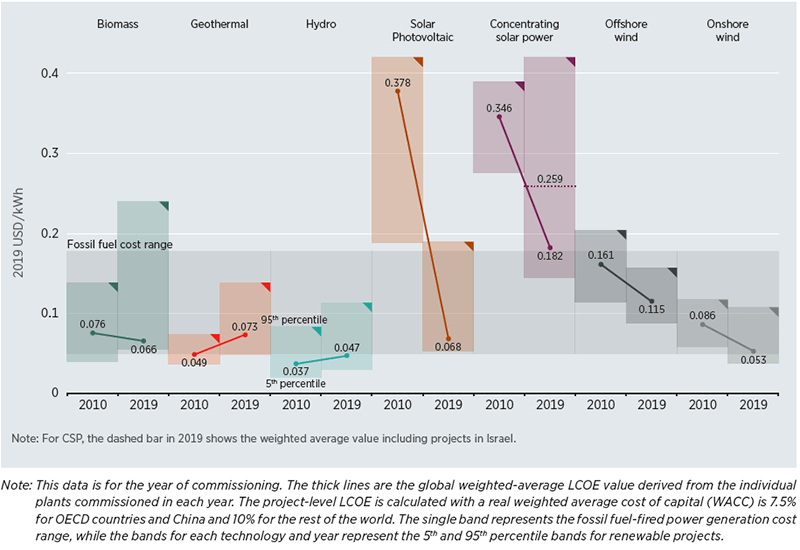

Renewable Energy Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Solar Power Tax Credit Transferability Is On The Table Pv Magazine Usa

A Guide To New Mexico S Tax System New Mexico Voices For Children

Renewables Already Gaining In New Mexico As State Accelerates Rps S P Global Market Intelligence

Electricity For West Texas And Southern New Mexico El Paso Electric Moving Forward

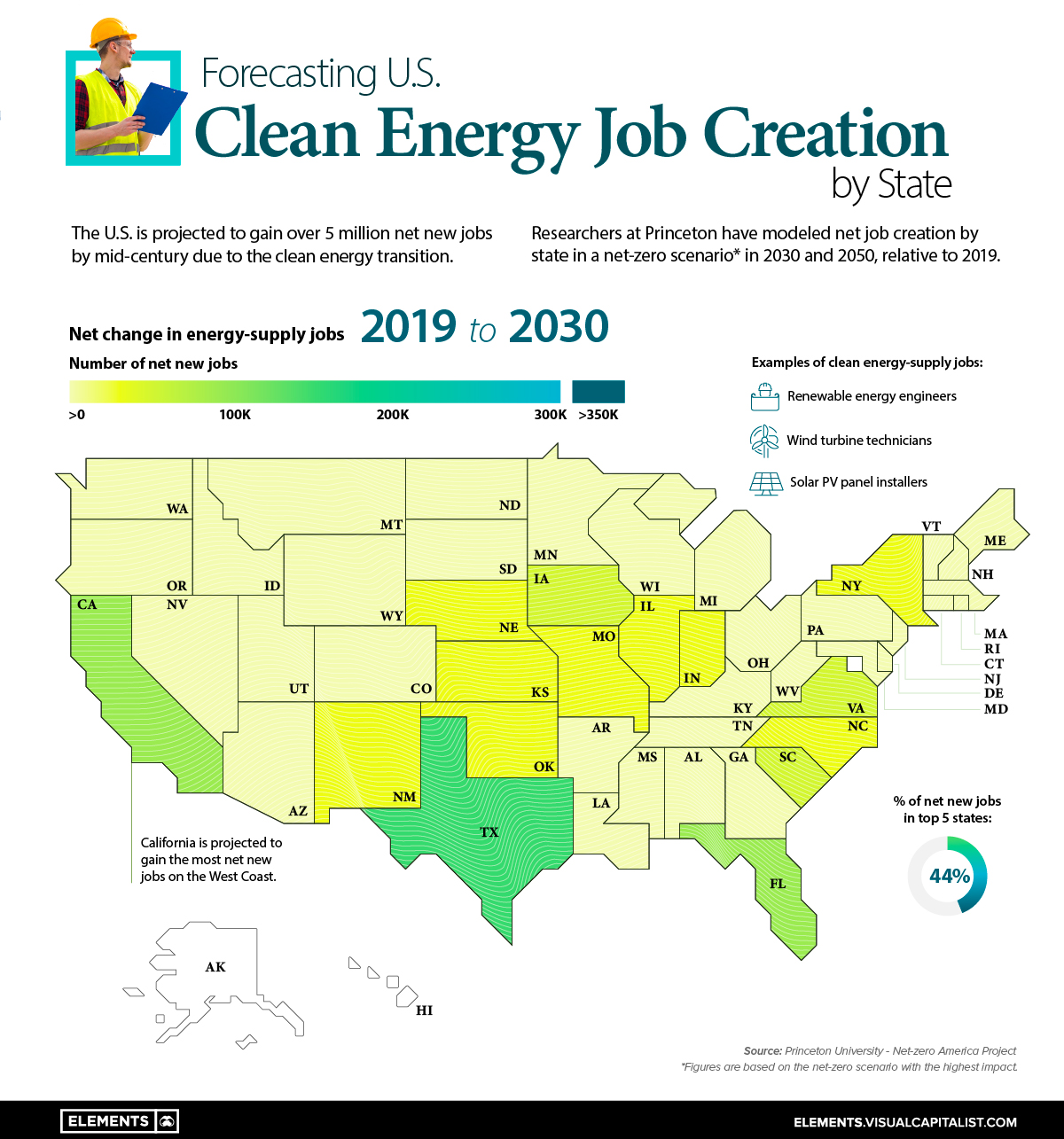

The Growth Of U S Clean Energy Jobs By State 2019 2050

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power